I haven’t posted in a while, but I’m keeping the web server up for other purposes, so I left the blog up anyway.

Not much has changed, we’re still saving aggressively, but Dad has a new job that pays 30k less than his old one, and the benefits aren’t quite as great. But, the benefits to him and the family as a whole are definitely worth the difference in salary. The new place also pays 8% into his 403b – whether he contributes or not (he does). We lost the ability to contribute to an HSA, but that’s OK. Adjusting to paying just a co-pay for our health care has been an adjustment, we know what we’re going to be paying at the time of care.

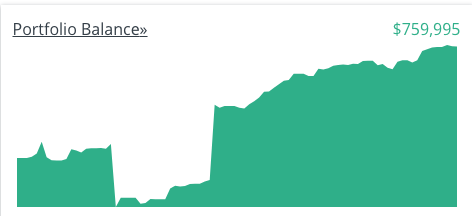

We have over $1.1 million in our investment accounts, and it’s finally staying there through some ups and downs. We’re still contributing just as much to our investment accounts, just not all in the same types of accounts – there’s a lot more money going into our taxable investment account these days. We’re just living on less – giving up a few things that were nice to haves like the cleaning service, or meeting with the personal trainer twice a week and meeting with her once a week instead.

The maxim of “money makes money” is certainly true in our case. The graph of our investment balances is exponential, and continues to grow. We’re slowly starting to shift our asset allocation more towards bonds as we approach retirement (less than 10 years!), but we’re still pretty heavily invested in stocks to support a longer than “standard” retirement. We’re shooting for 25% bonds for now, but all of our new investments are going to 40% bonds/60% total market to slowly change over that allocation over time. We’re also starting to increase our cash buffer from 3 months of cash to 6 months of cash, and eventually to 1 year of cash.