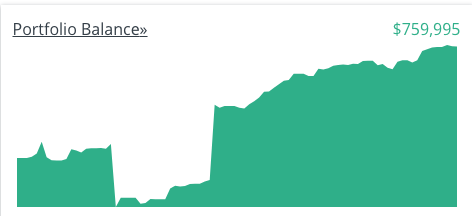

We’ve finally moved into millionaire territory after flirting with it for so many months. It’s still less than our desired amount for retiring, but we’ve passed another major financial milestone. Our retirement accounts are flirting with $875k right now, and I’ll be happier when those reach $1million. Our net worth includes our vehicles and our house (minus mortgage of course).

We’ve been both busy and boring this year. Saving a lot of money, spending some of it on vacations and fun, but otherwise boring in the money department, enjoying our summer with an almost 2nd grader, and resting up for the upcoming school year. Daughter Person is at her first sleep away camp for the week (Girl Scout camp), and we’re picking her up today, so we’ll see how she liked it. We already got a call that a cabin mate had lice, and could they use a lice preventative shampoo on her – seriously, like you had to ask?? What parent is going to say no?

We’ve made three trips to the Niagara, Ontario region – took our exchange student to visit the falls, and then had a nice week with just the adults touring the wineries up there, and a final one visiting friends who have just completed the adoption of their foster children having a welcome home party. Our exchange student’s family came to visit, and we visited DC with them, and they enjoyed some of what Pittsburgh has to offer. We’ll be visiting them in Slovakia next summer – it will be Daughter Person’s first (non-Canada) international trip.

Other than those few trips, summer has been uneventful, although we’re starting to plan to finish our basement next summer (another DIY job!), and that’s becoming a bit eventful as we try to figure out how we’re going to use that space.