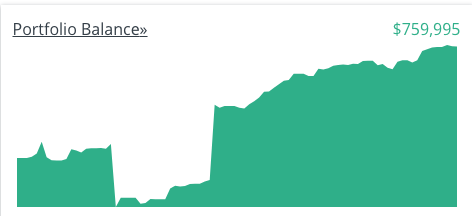

Since the number has stayed above 750k for the last few weeks, it’s time to say that we have more than 750k invested. 15k of that is a 529plan for college, so it’s not all retirement focused, but it’s still a significant chunk of money. It doesn’t seem that long ago when we had half a million in our accounts (just over a year and a half). It’s true, once you have money, it grows quickly. We’re approaching the 1 million networth mark as well – Personal Capital claims it’s 867k right now, but I know that’s off since it hasn’t synced certain accounts in over a month. When it comes to deciding if we have “enough” to retire, it will be purely based on our non-529 investment accounts and not our net worth.

The gap in the graph is when Dad’s 401k moved from Mass Mutual (cheapest S&P500 index was .83%) to Fidelity (.05%). I’m much happier about the move, since we have real choices for investments in that account now – and significantly lower fees. We didn’t have access to log into either account for just over a month, so neither did Personal Capital.

Are you basing your retirement off of invested assets or net worth?