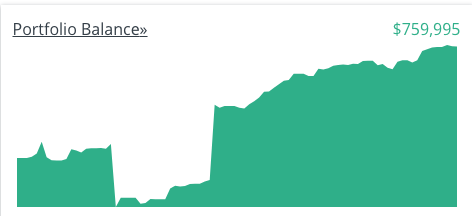

This year, we contributed $70997.76 (101.43% of planned) to our retirement accounts, and have gained $108,709.34 (298.25% of planned) in investment value. 11k of that is still waiting to be invested – we’re on the cusp of whether we can contribute to a Roth and if so, how much. As of right now (using preliminary numbers from final paychecks), we won’t be able to contribute the full 11k. Anything we can’t contribute to a Roth will go into our taxable account. I just need to wait until we do our taxes.

2017 was a good year financially. We made several large purchases, deck materials, a piano, tonsils and adenoids out, and still managed to contribute more than 50% of our take home pay towards retirement – I can’t say it hasn’t been tight at times though. I got a slightly higher than standard raise this year, and Dad got a raise (apparently, at his new company, that’s less frequent than “regularly”). We’re moving more and more into the Roth phase out income bracket. There are worse things than raises though.

I’m not looking forward to the new tax laws restricting state, local, and property taxes, as we pay a *lot* of those, well more than the 10k limit (heck, our property taxes alone are higher than 10k). There’s not much we can do about that other than move, and that’s not a move we’re ready to make yet. Depending on the implementation, we may also have a much higher MAGI under the new tax code and will push us even further into the Roth phase out bracket – or even into the not able to contribute range. We’re still going to save the 11k, but probably put more of it into our taxable account next year.