November’s Numbers

As of December 6, 2013, we are $453,754.87 in debt (that includes the mortgage). Without the mortgage, we’re at $34,545.82 in debt. This includes a credit card, student loans, and an auto loan. We currently have $992,308.23 in assets (including our house). Our retirement accounts are at $337,687.88. Our Net Worth is $538,553.36 (includes house and mortgage), up from $522,143.05 last month (3.14% increase).

I’ve paid our contractor for the painting and gutters – sort of. The check was sent off by the bank mid-November, but it’s not been cashed yet, so the slightly over $7k is still sitting in my checking account until it’s cashed.

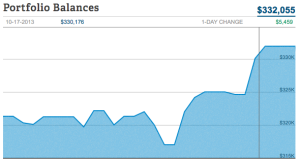

Our retirement accounts are up despite the last few days of a down market. I did like seeing those balances topping 345k though. They’re up 1.38% from last month, not as great of an increase as the last few months, but still respectable. And they are 31.38% more than January of this year – granted that includes contributions as well, but it’s still nice to see that number increase.

We might top $1mil in assets before the end of the year, and that will be pretty neat – a “millionaire” by at least one measure.

Dad got a bonus that we applied to our Chase card this month, so we got a nice boost there. I may or may not get a bonus, depending on how my company has done this year – I’m not expecting one, but it’d be a very nice surprise if it happened.

We’re on track to have all of our non-mortgage debt paid off at the end of 2014, but we will no longer be paying interest to anyone but the mortgage company starting about June – our car loan is 0%. This may trigger us to pump more money into our company retirement accounts and emergency fund before slaying that last debt. It’s something that Dad and I have to discuss – go with the math of getting a better return – or the emotional “win” of getting rid of all non-mortgage debt?

Debt (in the order we’re paying it down):

- Line of credit (8.75%): $0.00

- Chase (4.99% for life): $ 1,992.53 (-1,982.85)

- Student loans (aggregated 6.55%): $12,643.00 (-139.71)

- Car loan (0%): $20,050 (-490.00)

- Mortgage (4.125%): $ 419,209.05 (-671.46)

Total paid off in November: $3,284.02