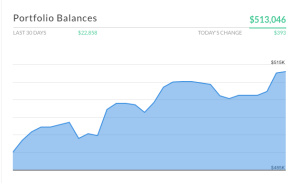

We contributed $4,922.1 this month to our retirement accounts, and we gained $1,922.77 in investment value this month.

This was a “low” contribution month for us (relative to previously, but it’s our new monthly contribution. Dad’s company’s HSA contribution gets contributed on a twice monthly basis (41.66/paycheck) rather than a large contribution like at his old company. We’re also reaping the benefits of not paying Medicare or Social Security taxes on our contribution. We had some problems with them getting the right contribution, but we think that it’s been worked out going forward. We’ll be 4 cents below the federal maximum for the year, then we’ll have to make a decision on whether to continue with the HSA next year or move to a PPO plan ($75/mth premium for the HDHP and $130/mth for the PPO plan).

We are seeing about 2k more per month in our budget, and that will be used to save for a possible Roth contribution. If the money isn’t able to go to our Roths, it’ll go towards our taxable account – but won’t actually get deposited until March/April of 2017 when we know if we can do a Roth or not. Based on a back of the envelope calculation (gross salaries – 401k limits – standard deduction), we’ll be barely under the threshhold (by $500), so when I actually calculate it using itemized deductions, we should be good.

2016 Totals

In 2016 we contributed $34,416.81 (49.17% of our goal of 70k), and gained $16,553.36 in investment value.